Take a look at this list of results: over a million customers, sixth biggest lender, challenger bank status, most recommended bank and so on. This looks pretty impressive for Australia’s self-proclaimed “oldest fintech” having been operational in the country since 1999.

How does the multinational bank ING do it? Some common themes used by analysts to describe the bank’s strengths are intuitive customer experience, digital disruption, and simplified business structure.

Last month, ING released Australia’s first set-and-forget savings feature that lets customers save as they “run, walk, tweet or shiver.” This uses an IFTTT (If This Then That) integration for the automatic triggers and money transfers into a customer’s savings account.

ING’s latest tech-enabled innovation is just one among their many tactics to reshape “how banking can be.”

In this article, we will delve into ING’s success pillars and analyse some of their moves in Australia.

Customer-focused strategies help fuel growth

“Too many organisations spend too much money telling customers how wonderful they are and not enough money on actually serving the needs of customers.” - ING’s former CEO

1. The IFTTT campaign

Let’s go back to the campaign mentioned at the start of this article.

I have been using IFTTT to automate useful tasks, from “IF it rains tomorrow THEN send me a notification”, “IF I post on Instagram THEN post it to a Slack channel”, to more peculiar tasks like “trigger a phone call to yourself so that you can politely excuse yourself from an awkward situation.”

When ING leveraged this nifty platform, I thought this was a brilliant move on multiple fronts. From a Jobs to be Done perspective, ING articulated pretty well their customer’s job, which is to put away money into savings without having to actively think about it.

Check out some of the savings triggers available for the action “move money to my savings account” in the image below.

Source: IFTTT

Source: IFTTT

Human angle

ING understands that their customers are already interacting mainly on mobile, using common apps and utilities which makes the IFTTT integration a natural extension, i.e. the barrier to adoption isn’t high.

Moreover, ING understands that saving money isn’t fun, so they went with a gamifying angle. The choice of triggers include things that are relevant to everyone, from passive ones like “when temperature drops”, to active ones like “when you achieve your Fitbit goals”, and social ones like “when you post a status on Facebook.”

These also help customers achieve the emotional and social jobs of saving money besides functional ones (other elements of the Jobs to be done framework).

Technology angle

With the triggers available when using smart speakers, ING could be paving the way/testing the waters for potential voice banking applications.

Moreover, opening up an enterprise backend to external parties is a scary thought for many, yet to enable this new feature, ING opened its APIs to IFTTT.

The benefits from being able to create new customer experiences outweigh concerns around proprietary or security issues.

ING said: “This is an example of how by securely opening our APIs to third parties we’re able to help meet the ever changing banking needs of Australians.”

We previously covered the topic of APIs in relation to microservices and the new software paradigm.

Business angle

How does this feed into their business strategy? Some might see this as a flashy campaign but the IFTTT initiative highlights a few points:

- Staying true to their origin as a competitive savings account

- Getting ready for “open banking” by opening up their APIs (more on this later)

The new campaign also builds on the success of ING’s previous savings feature Everyday Round Up, which helps customers save money while spending by automatically rounding up loose change into their savings account.

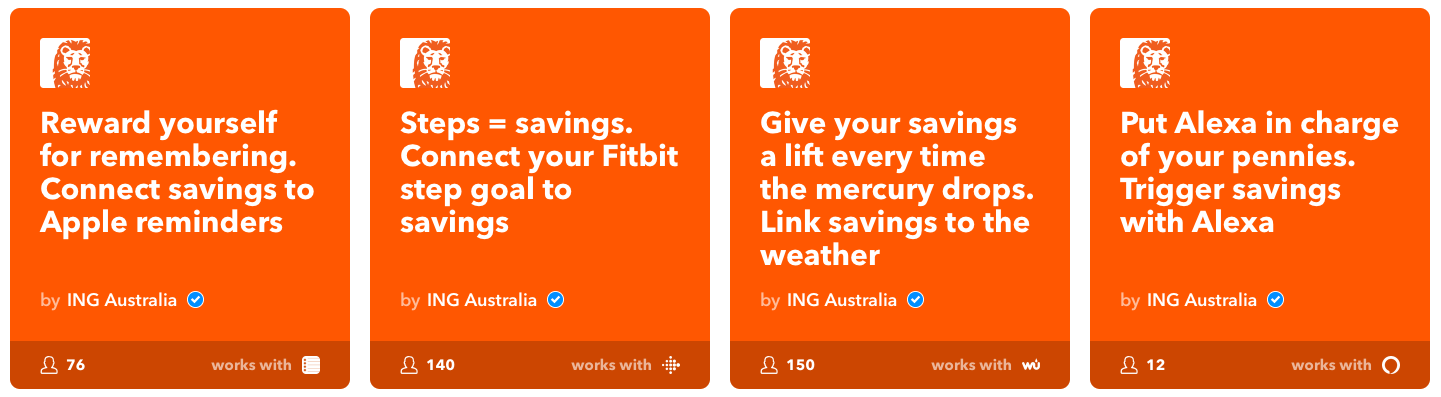

2. The referral campaign

We all know the power of customer referrals or word of mouth (see our blog post on Customer Experience). ING was very early in understanding the amplification of social connectivity and the ease of sharing. Now combine that with some monetary incentives and you have the ING’s referral campaign, which has been running for several years.

Rewards for both the referrer and referred have ranged from $25 to $100 per referral.

Rewards for both the referrer and referred have ranged from $25 to $100 per referral.

Last year, 40% of new ING customers came from referrals. With no physical branches, no TV advertising, low brand awareness compared to major banks, this makes sense for customer acquisition.

Even without a referral, a new sign up still attract a $75 welcome bonus. This person might go on to refer more people in the future to earn a bonus. In a way, this helps curb the churn issue because customers have more motivation to stay, besides the product benefits to be discussed throughout this article.

3. The email communications

Enabling cross-sell and upsell

Without physical branches, digital communications to customers must be spot-on. The usual lead nurturing practices would have had ING simply sending out sales emails after certain periods of time and “hassling” customers till they take an action (which may lead to unsubscribing).

But ING knows better than that.

Enabled by data analytics, the bank automate personalised email campaigns sending targeted and contextually relevant offers across digital channels including the website, which we will discuss later.

The results? 120% increase in incremental sales conversion and 45% year-on-year jump in cross-sell purchases.

Another contributing factor to the effectiveness of ING’s email campaigns is the focus on loyalty and advocacy. They recognise that:

- Chasing new customers over rewarding existing ones is unfair

- Meeting customers at their “moment of truths” is crucial

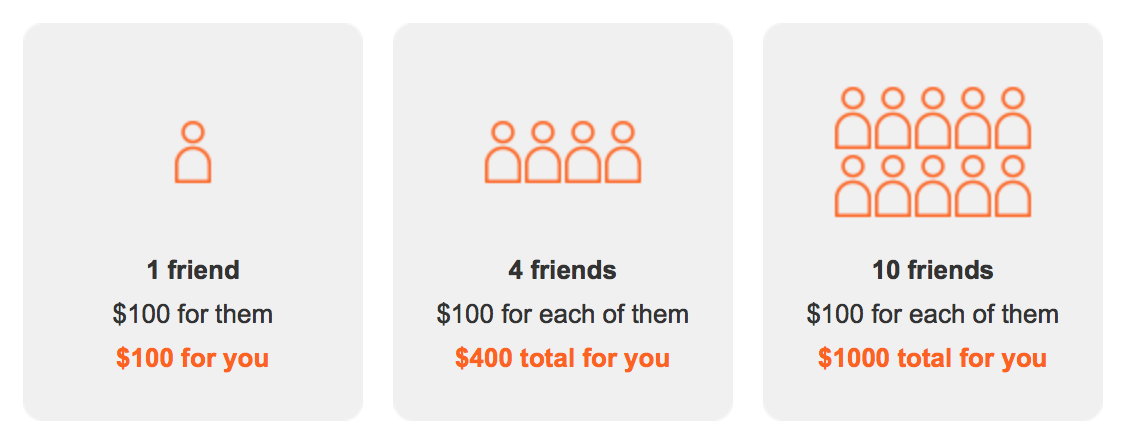

Benefit reminders

Together with the cross-sell and up-sell emails, the benefit reminders serve as a loyalty building tool. These emails articulate the monthly and annual value provided to customers, which have double the open rate of any other email campaigns.

What I find particularly useful is the reminder email about the steps required to enjoy full account benefits (including free ATMs everywhere, no international transaction fees etc.) The image below shows the two steps customers need to do every month and whether they have been ticked off.

This presents ING as a helpful assistant who genuinely doesn’t want customers to miss out on benefits. Wouldn’t it be good if other banks out there sent you reminders like this to help you avoid the sneaky monthly account fees?

Plain-English transactional emails

Staying true to their motto of simplicity, ING has managed to disrupt the perception of traditional banking lingo.

Their transactional emails are jargon-free and straight to the point, e.g. for new payee, transfer confirmation etc.

“The essence of simplicity even flows down to the way our developers write error messages.” - ING’s CIO

What’s admirable here is ING is not taking an entitled attitude where organisations “impose jargons” on customers because the [banking] industry has been around for hundreds of years.

Snapshot of ING’s straight forward T&Cs

Snapshot of ING’s straight forward T&Cs

So this is powerful on two fronts:

- Making the current customer experience pleasant

- Thinking ahead, this is actually preparing them for the future of conversational user interface with AI’s natural language processing capability.

4. The convenience enabler

Recognising that people are increasingly willing to switch banks that provide better digital experience, ING wouldn’t hesitate to give customers the convenience they desire.

“We are digital first, and increasingly mobile first. Our customers are the most digitally engaged of any bank in this country.”

Seamless payments

For instance, they listened to customers’ demand and enabled Apple Pay early on, only after ANZ in Australia.

Other big banks focused on protecting their own turf by using their own NFC pay tag, or filing to the Australian Competition and Consumer Commission for permission to collectively negotiate against Apple. Were the big banks scared? Were they naïve? Apple said they could be missing out on the future of payments.

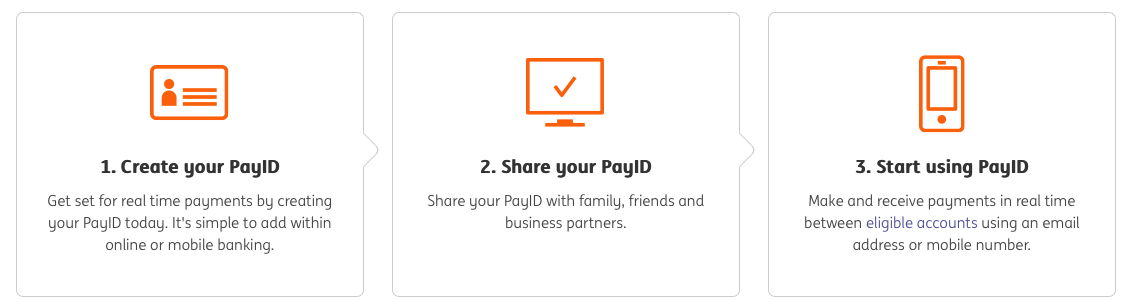

Another payment innovation in Australia this year is PayID, which enables instant transfers between Australian bank accounts without having to remember/know one’s BSB and account number.

People can create a PayID for their chosen bank account using either a phone number, email, or ABN. So why do many banks allow only one type of PayID? Obviously ING allows more than one type, because it goes back to serving customer needs.

PayID instructions from ING

PayID instructions from ING

Voice banking

Again, as an example of responding swiftly to consumer demand, ING was the first Australian bank to enable Siri to check your bank account balance. They also have plans to expand Siri’s command lists for things like making transfers and payments.

Among the big banks, NAB and Westpac have launched voice banking tech with Amazon Alexa and Google Assistant.

Limited to moving money into savings for now, ING also has an Alexa and Google Assistant integration through IFTTT (mentioned at the start of this article).

Why the differences in priorities?

- ING went after the largest segment of their customer base: iOS users

- Compared with other big tech companies, Apple has generally been considered better with privacy issues, which voice banking might raise

5. The lounge concept

ING doesn’t have branches or ATMs like traditional banks. They leverage others’ networks:

- They partner with Australia Post to enable Bank@Post for the most common over-counter banking transactions.

- They offer free ATMs provided certain conditions are met (mentioned in previous section).

But ING does have one physical branch in Sydney called the “ING lounge.” Going with a friendly and informal style, this is reserved for money-related consultation and digital coaching.

Website copy that makes it more human. Source: ING

Website copy that makes it more human. Source: ING

The lounge serves the purpose of warming customers up to bigger purchases that require human interactions, i.e. mortgage. ING’s main distribution channel for this product is still the broker network, and the lounge is an upgrade of their direct channel.

6. The social enterprise accelerator

Dreamstarter is an ongoing initiative that helps social enterprises through a crowdfunding platform.

We mentioned ING in our article about the future of brands, where trust is built beyond cause marketing.

By now, it’s possible to say that ING’s strategies/tactics are usually multi-faceted. What I mean by this is they are intentional, rather than shooting in the dark; they have potential effect across different areas (human, business, tech), rather than being an isolated phenomenon or one-hit wonder.

With the Dreamstarter initiative, it is about giving back to the community, and building trust to the extent that:

“ING’s overall Net Promoter Score is about 56, the highest of any bank in Australia. By comparison, the average overall rating for the big four is minus 23.”

Source: Australian Financial Review

What it means to be Digital-first

In this section, let’s talk about how ING built a “$50 billion balance sheet with 500,000 transactions on a daily basis purely by being a ‘digital destination’”.

IT Architecture

Being a branchless bank, ING needs to ensure “extreme availability.” In fact, the digital platform needs to be available to customers 99.9% of the time.

What’s also interesting is the bank’s redesign of its software architecture to be modular and Lego-like. This has allowed them to ship out new tools, such as the Everyday Round Up feature mentioned above, at half the time it used to take.

The new architecture involves a Google’s Polymer application toolkit in and a customised API Blueprint platform. While all of these sound technical, the concept is simple: instead of a monolithic architecture, ING picks and chooses the best bits, swaps out what they don’t want or customises the bits they want.

Mobile banking. Source: ING

Mobile banking. Source: ING

This modular characteristic is emblematic of microservices - which we’ve talked about extensively in a previous post.

Similar to the app architecture, ING’s website was also built in a modular fashion. This allows other ING businesses around the world to pick only the “modules” they want.

ING’s head of IT strategy sums it up nicely:

“We no longer build applications. We have, and are enriching, a module market sourced from industry and the ING global community. Modules are assembled into applications as the business requires.”

Culture & operations

The right tools won’t magically get results if there aren’t the right culture and processes to support them.

ING transitioned from waterfall to agile two years ago, and became inspiration for ANZ’s own Agile shake-up. They even rolled out Agile further across the enterprise with the “BizDevOps” model, which is basically bringing the Business and IT teams together.

A recent survey on corporate innovation says the majority of companies takes 12 months or more to launch a new product.

Within just one year, ING managed to launch a bunch of them, from payment tech integration, to credit card and insurance offerings.

Customer involvement

As a digital-first bank, it’s natural for ING to invest heavily in their web & mobile channels. If you look at the recent two-year journey to overhaul their digital platform with the help of more than 16,000 customer volunteers, now that’s true customer focus.

It was the biggest single investment up to 2016, to the tune of tens of millions. But ROI will be quick. Because instead of mass advertising and marketing to customers, ING can personalise offers based on behavioural analytics (see the section on email communications above).

This decreases the likelihood of the sequence: irrelevant offers > disengagement > customer churn. After all, they had customers co-design the website overhaul through five stages.

User experience

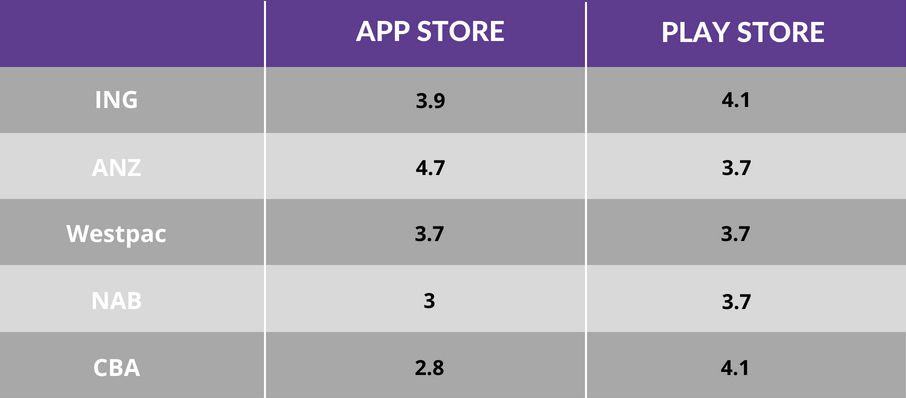

Since most banking transactions are done on mobile devices, let’s zoom in the mobile app. The table below shows the user ratings for ING and the big 4 banks on the two main mobile platforms.

App ratings by users (out of 5) as of July 2018

App ratings by users (out of 5) as of July 2018

It seems that ING’s simple mobile app User Interface and User Experience has scored points with customers, putting them just after ANZ in the overall rating (that is if you compare the averaged score for 2 platforms).

This presents a counter-intuitive notion at first: Tech needs to get out of the way. That means, banks shouldn’t want to keep customers in the app, but help them get the job done and move on.

“People don’t have time these days, and even if they did, they don’t want to spend it on banking.”

Now let’s look at the mobile banking evaluation from an independent research body. In Forrester’s 2017 Global Mobile Banking Functionality Survey, CBA and Westpac topped the list in Australia, and are in the world’s top 10.

Why such disparity between consumer and “academic” evaluation?

“Verbatim customer responses suggest the CBA app rates highly due to features, while the ING app is far more simplistic, but resonates with customers due to ease of use and visual appeal.”

The researcher also mentioned strong brand perceptions, or customer expectations flowing through to mobile app ratings.

In this case, customers have come to expect simplicity from ING, and that’s exactly what the bank has delivered with the app.

On the other hand, CBA’s branding is around “Can” - or the bank saying yes to customer requests. Thus, it may be natural to expect broad functionality from the CBA app.

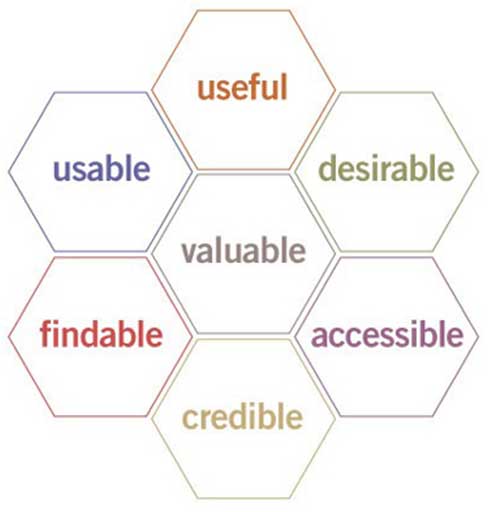

If we go back to explaining the evaluation disparity, the CBA app satisfies the functional element, i.e. has lots of features, but might not be as usable as the ING app. After all, there are other elements making up good User Experience that companies need to consider.

Source: usability.gov

Source: usability.gov

Here are some wise words from Forrester about Spanish bank BBVA who has the best banking app in the world:

“Becoming customer-obsessed is not about focusing on adding new mobile banking functionality, it is about putting customers at the heart of what the bank does.”

In other words, banks need to understand the customers’ jobs-to-be-done.

One point of criticism for most Australian banking apps though: Accessibility. ANZ seems to be the only one among the banks listed above actively promoting their accessible mobile app.

Even something as simple as leveraging Apple iOS built-in text scaling feature is absent in those banking apps, including ING.

So banks could be missing out on this overlooked market segment. And all it takes to get started might just be doing an accessibility audit.

Getting ready for digital disruption

To kick off this section, here’s a quote about the banking industry’s existence, or any industry for that matter:

“Customers need banking not banks.”

This and a similar saying “Banking is necessary, banks are not” (both attributed to Bill Gates back in the nineties), highlight the need to constantly stay relevant by focusing on customer needs.

Unbundling of banks

Even though ING is considered a challenger bank relative to the big banks, we can still ask questions like: “When will the disruptor be disrupted?”

In our previous article on digital transformation, we’ve discussed how fintech startups can disrupt traditional banks by unbundling their services. These startups focus on providing one or a couple of services really well, e.g. wealth management, stock exchange, money transfer.

So what has ING been doing to fend off disruption?

- Constant improvements to make sure the core offering is the best there is for the customers (like what we’ve talked about so far)

- “Reward for bundling” because they realise they can’t be all things to all customers

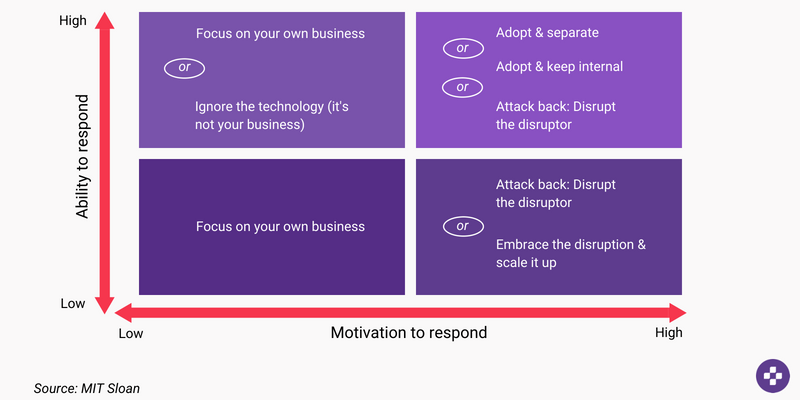

If we look at companies’ responses to disruptive innovation in terms of the quadrants from MIT Sloan below, banks are generally at the top left quadrant.

Some possible examples that illustrate this quadrant:

- Dismissing the disruptiveness of new fintech offerings

- Spending on improving internal processes/acquiring assets and not improving customer experience

- Forming alliance with “competitors” to protect own turf (e.g. CBA, Westpac, NAB vs. Apple Pay mentioned above)

- Closing off instead of opening up in terms of tech or business, whether internally or externally

Is ING in the same quadrant as most banks? I’d argue not. Let’s discuss further in the next section.

Open banking

With the general trend of “open everything,” open banking is already gaining traction, whether incumbents like it or not.

What is open banking? It’s a data sharing scheme that lets “accredited third-parties to access customer banking data via secure application programming interfaces (APIs).”

With open banking in place, certain transactional and product data now belongs to customers, not banks, flipping the existing model on its head. Effectively, that means more power to customers as they decide who they want to give such data to in exchange for better services and products.

Now cast your mind back to the IFTTT integration mentioned at the start of this article. ING has laid some sort of foundation for open banking in Australia (government rollout planned for 2019) by giving IFTTT’s access to their APIs to develop this offering.

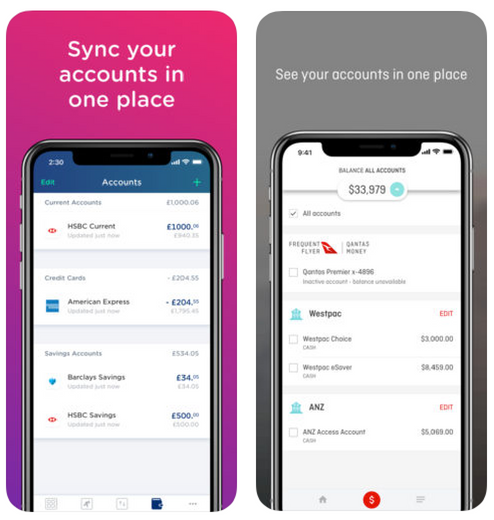

On the global stage, ING has joined the open banking movement with the launch of Yolt in the UK – an ING-owned fintech app that aggregates data from various financial institutions to give users an overview of their personal finance. An Australian equivalent is the Qantas Money app.

Yolt app (left) vs. Qantas Money app (right)

Yolt app (left) vs. Qantas Money app (right)

But is this the incumbents playing catch-up? Because some fintechs without backing from any bank or financial institution have launched similar apps at least 4 years prior.

Examples:

- Japanese startup Money Tree entered Australia in 2017 after launching successfully in Japan (2013) and the US (2014)

- Pocketbook is an Australian startup that launched in 2012

It doesn’t stop there. Open banking is heating up the competition with more parties wanting a share of the pie, including mobile phone operators, credit reference agencies, e-commerce providers, insurance companies.

Established fintechs like PayPal and Square are edging to jump in and take a cut from bankers. That’s not to mention global tech giants like Amazon, Google, Facebook and Apple wanting to do the same, just because they can.

With so much potential disruption flying around, it’s hard to understand why banks want to stay in that top left quadrant (see image above).

That said:

“Most bankers also recognise they may need to disrupt themselves to remain relevant in a fast-moving technology-driven economy, so adaptation is key.”

Source: Australian Financial Review

To start the journey of adaptation, banks need to overcome things like legacy systems, lack of speed and agility, lack of user-friendly interfaces and digital experience.

Some enabling building blocks for adopting open banking already being utilised by fast movers are APIs, microservices, and DevOps.

It’s worth noting how ING is tackling this on both the global and local front, and that the gap between the two is pretty close. Remember the modular architecture mentioned above that allows ING businesses around the world to pick and choose what they want? Perhaps this leads to more unity (shared resources) as well as innovation (learning and improving on each other’s work) across the whole group.

Platform business model

Going back to ING and their preparation for open banking, consider their ambition of being the “WeChat of banks.”

ING aspires to form its own ecosystem by becoming a platform that connects and aggregates from other platforms.

We wrote about the platform business model before. Here, the global bank wants to take it one step up by being a collection of platforms instead of a singular platform.

The key to any platform’s success is connectedness.

“That means using the right architecture with open APIs and global IT systems.”

It seems ING is in the top right quadrant of the disruptive innovation response mentioned above, i.e. having high motivation and capability to respond.

Can the bank fend off other fintechs or tech giants like Amazon getting into financial services? Could ING’s digital transformation grow to the scale of WeChat? It’s indeed an exciting space to watch.

Key takeaways

Here are the main points to take away from the ING story:

- Great user experience goes a long way

- Don’t let corporate antibodies develop

- Talk buzzwords all you want, but walk the talk

- Invest in tech, with the customer in mind

- Open up, or get eaten up

- Monitor the landscape, experiment, learn, repeat

Disclaimer: All the views here are from my personal experience of being a customer. I am not employed by or affiliated with ING or its subsidiaries in any way whatsoever.