I remember pouring heavy capital from my “cash cow” into R&D for a new product in a new category. I remember the thrill and anxiety of launching into an unknown territory without much market information about consumer preferences, segments etc.

I remember trying to reap the first mover advantage for my company so much that I was determined to outspend my competitors on R&D (and get that info by purchasing market intelligence).

Launch week: everything seemed to go according to my predictions until one competitor figured out the formulas of the whole system and basically took over the “game”.

The story I just told you is about my virtual company on marketing simulation platform Markstrat during my university course on strategic marketing.

For those who haven’t heard of Markstrat, it is a simulation game where you control the fate of your company while competing with your classmates’ companies.

A screen in the game. Source: StratX Simulations

A screen in the game. Source: StratX Simulations

Now, technical limitations aside, recent trends in commerce has prompted me to think about what I could have done in Markstrat. What if I had been able to apply “pre-commerce” in this simulated environment?

What is pre-commerce?

Pre-commerce is a product development method which allows new product ideas/prototypes to be mass produced only when they have reached an initial threshold of buy-in from investors/consumers.

Essentially, pre-commerce:

- Taps into upfront investments from consumers, either in terms of capital or expertise

- Applies to products not yet at the mass production stage

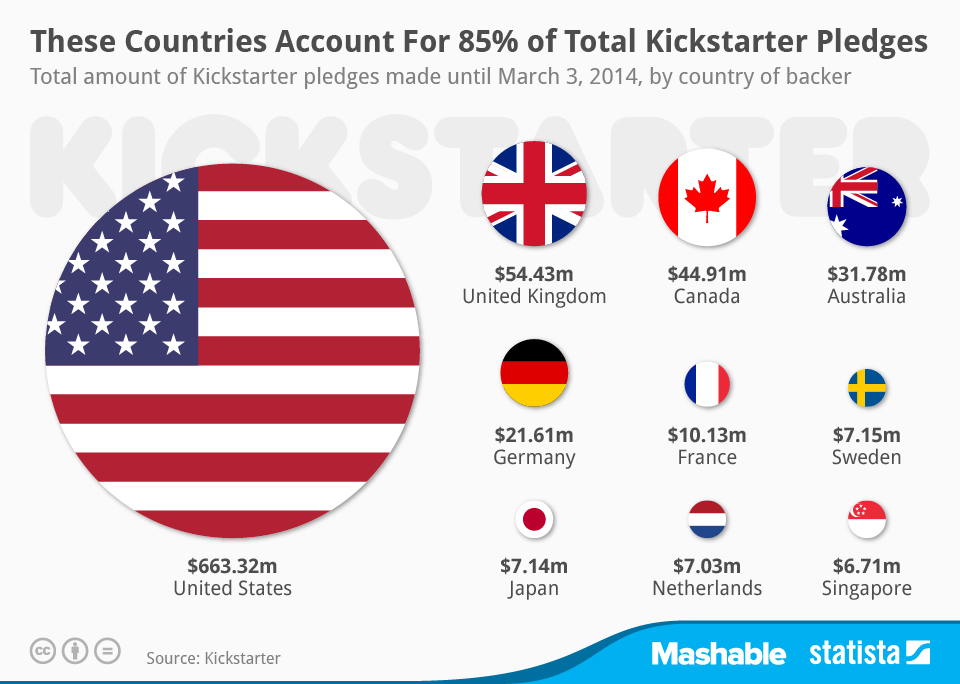

Quick examples:

- Tesla’s model 3 pre-order

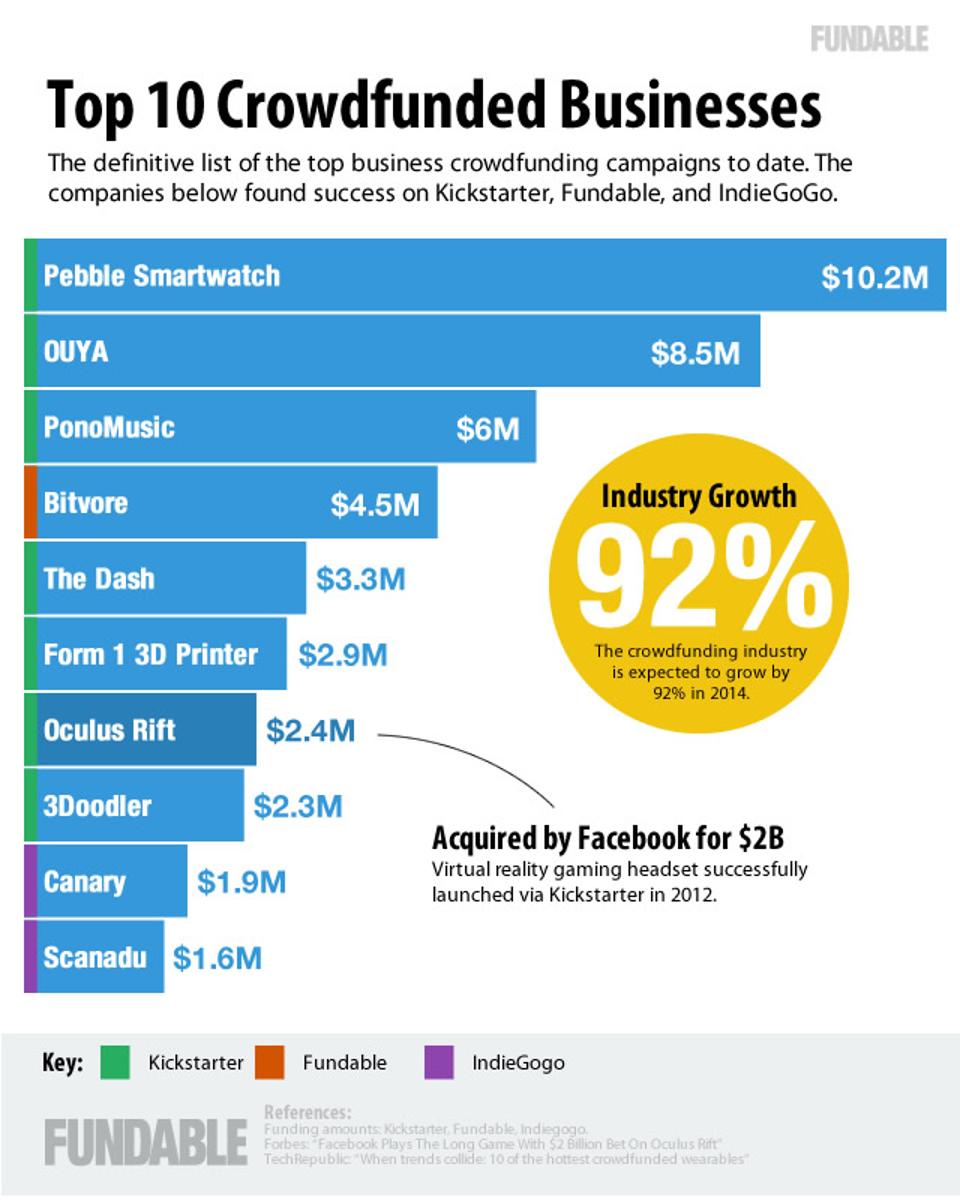

- VR gaming headset Oculus Rift funded through Kickstarter

- Other examples shown in the graph below

Source: Forbes

Source: Forbes

How it could have played out for me

Back to my Markstrat adventure, I could have organised a campaign around my new product on a Kickstarter-ish platform.

Instead of worrying about what my competitors were doing, I could have focused on building a community of early supporters, collecting feedback and fine-tuning my new product to best match their needs.

Now my competitor could also have copied my move. But they wouldn’t have been the first-to-market. Potential simulation scenarios for this imaginary Markstrat feature:

- My campaign reached 34% of buy-in first - the tipping point which improved my success rate to 99%. First mover advantage: check.

- My competitor’s campaign reached 34% first. To compete, I would need to either amplify my communications, leapfrog their technology, or go niche. Fast follower: maybe.

- No campaign reached 34%. Re-evaluation in order: technology might be too new and takes time to get used to; latent demand; plus other things mentioned in the second bullet point.

We’re not here to discuss feature improvements for Markstrat, but what pre-commerce is and its potential.

However, if you wait till the concept is established enough to be included in textbooks, or a simulation game, you might have already missed the boat.

Pre-commerce allows new product ideas/prototypes to be mass produced only when they have reached an initial threshold of buy-in from investors/consumers.

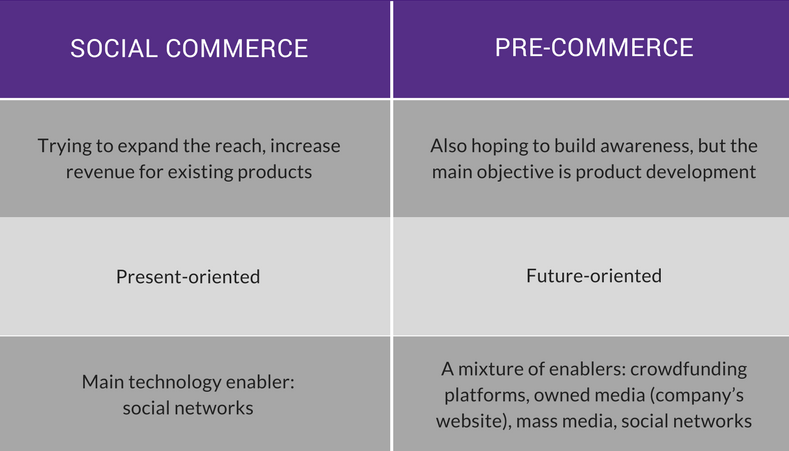

How pre-commerce is different from other forms of commerce

To understand a new concept, it is equally useful to consider what it is not.

Don’t get mixed up with social commerce

There is a prevalent viewpoint that sees pre-commerce – or participatory commerce, or pre-tail – as a trend within social commerce.

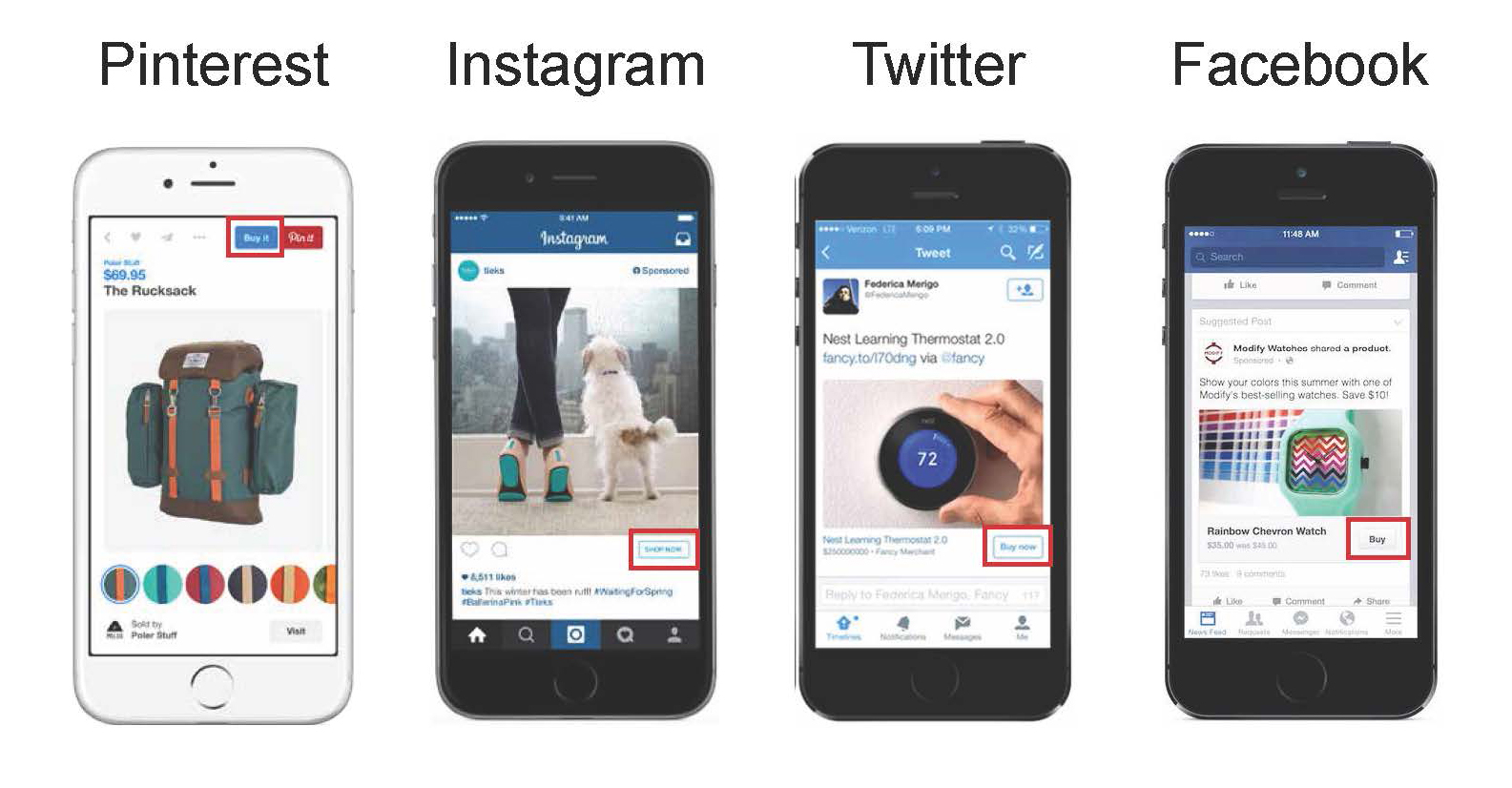

This is odd, because social commerce is defined as the coming together of retailers and social networks to bring customers a better online buying experience. The most common tactic is integrating the “buy button” into a company’s social media presence, as shown below.

Source: AWG

Source: AWG

Also, check out this list of social commerce definitions for your reference.

It’s more accurate, and even beneficial, to make pre-commerce a category of its own because it involves more than just the selling mechanisms.

Pre-commerce touches other areas of the business, from product innovation (concept & ideation), supply chain management, to marketing and sales.

Differences between the two

Differences between the two

Does it work like a Marketing stunt?

While most campaigns on platforms like Kickstarter employ social media to trigger the viral effect, pre-commerce is not a short-term, quick-win kind of tactic.

Remember Cadbury’s vegemite chocolate? While the whole campaign had some pre-commerce flavours (as the vegemite chocolate actually got manufactured), it was mostly a “marketing thing.”

A tweet from Cadbury back in 2015 to promote their campaign

A tweet from Cadbury back in 2015 to promote their campaign

Why? Because unless those people who joined the social media conversation around hashtag #ChocPlusWhat put in $2 to get the vegemite chocolate first when it came out, they were only giving Cadbury their two cents on the matter.

More importantly, Cadbury might have already planned to make this chocolate flavour and the campaign’s purposes were to:

- Stir excitement/debate/curiosity pre-launch

- Cause a short-term sales surge

- Cause a brand uplift (either short or long-term)

In a marketing sense, pre-commerce shares purpose #1 and #3. But the underlying thinking is to jump in before the traditional product life cycle kicks in, as shown below. (Note: Refresh page to restart animation)

How pre-commerce affects sales and profits compared with traditional commerce

How pre-commerce affects sales and profits compared with traditional commerce

How pre-commerce lets you get ahead of competition

It is a powerful product development engine, fueled by evolutions in consumer preferences for innovative products and community engagement; as well as lower entry barriers for new product development.

Consumer preferences evolution

Consumers increasingly value experiences over physical goods, which gives rise to experiential buying. Now that doesn’t mean you’re doomed if you make physical products. It means adding to the product by creating a memorable buying experience.

Pre-commerce does it by:

- “Providing a sense of belonging that goes beyond the thrill of possession.” Think about how crowdfunding or community-led invention platforms (e.g. Quirky) make consumers feel they’re part of a community/movement.

- Injecting status into the buying experience, focusing on messages like “the newest,” “the first,” “I help launch it.”

- Tapping the increasing demand for new trends and novel products. Studies have shown how novelty “motivates the brain to explore, seeking a reward.”

Source: Statista

Source: Statista

Market evaluation tool

Pre-commerce allows innovators to test their product-market fit with a Minimum Viable Product (MVP) equivalent. Since consumers would only back projects they like, it helps makers accelerate innovation, ditch waste and tweak offerings along the way.

Depends on the sources you read, the failure rates of new products (not launched through crowdfunding) range from 40-80%. For crowdfunding, those rates range from 40-90%.

On the surface, you may think it indicates similar chances of success but the risks could be reduced with pre-commerce. Would you rather pour millions into a product to learn a lesson, or one-hundredth of that amount?

Examples of failed launches involving big money: Coca-Cola C2, Pepsi Blue, Colgate Simply White.

Supply chain and finance

Recent changes in technology have helped bring down product development costs, lower barriers to entry and remove geographical restrictions for market exposure. Pre-commerce fits neatly into this landscape.

Moreover, by being able to gauge demand before mass production allows for more accurate financial forecasting and less inventory risk.

Innovators don’t need to deploy a business model purely based on pre-commerce to reap this benefit. For instance, Moda Operandi, a pre-tail fashion start-up, combines pre-commerce with e-commerce. The core business is about letting women pre-order fashion pieces straight off the runway via limited time online sales.

Source: Moda Operandi

Source: Moda Operandi

The company plans to expand leveraging “the sales data it collects from its ‘pre-tail’ business to inform its traditional retail buys, mitigating inventory risk by injecting an element of science into buying decisions that have traditionally been driven more by intuition than hard data.”

Others have also pointed to a new commerce pipeline that could become more prominent in the future: moving from pre-tail to e-tail and then retail.

Quick summary

Pre-commerce enables a direct-to-consumer model by fostering a closed feedback loop which results in:

- Marketing efficiency: marketing focuses on social mechanisms (rather than broadcast) as they have increasingly become the main source of product discovery.

- Margin efficiency: cutting down on the middlemen like physical retailers or distributors.

- Product efficiency: presenting MVPs and getting direct feedback from potential customers fosters innovation and eliminates guesswork.

What separates your brand and company from a world of innovative independent designers is only a semi-permeable membrane.

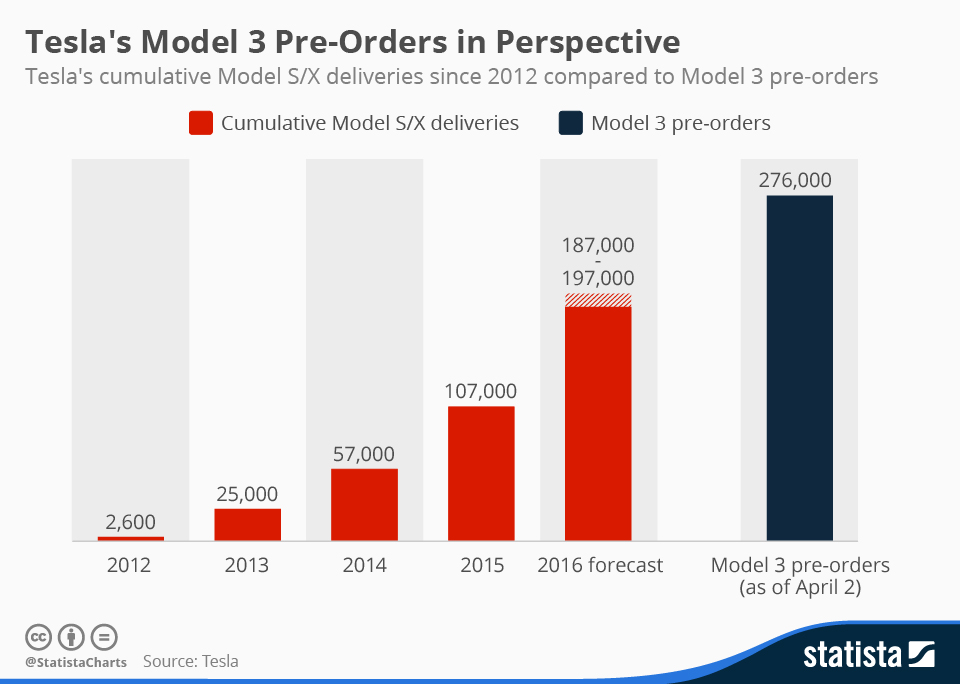

The fascinating case of Tesla

Recently, Tesla has caused a stir with their Model 3’s pre-order number nearing 400,000. The graph below shows that just one day after the official unveil event, Model 3 pre-orders already outnumbered Tesla’s previous model deliveries.

Source: Statista

Source: Statista

Surprisingly, allowing pre-orders for the more affordable Model 3 has increased demand for its Model S too. In other words, pre-commerce can result in demand on top of demand.

As the most innovative company in the world ranked by Forbes, Tesla’s R&D intensity is roughly triple that of most traditional car manufacturers. This heavy spending has been almost mirrored by their financial losses from 2010 to 2015.

Tesla was finally able to report its first net quarterly profit and a positive $100 million cash flow this year. Pre-commerce has helped Tesla significantly reduced the costs of launching model 3, so much so that it does not require any new capital raise.

How pre-commerce ticks all the boxes for Tesla

- Experience of being part of the Early Adopters group

In Australia, people lined up to pre-order Model 3 “despite not knowing what it will look like, how it’ll drive, or even how much it’ll cost.” They might even have to wait longer as the left-driving countries will get the car first. This goes to show experience trumps physical goods.

- Testing the market before heavy R&D / manufacturing

Clearly a lower end model has lured in more consumers from the “entry-level luxury” segment as they have shown explicit interest by giving Tesla money in advance.

- New source of financing the enterprise

No new capital required after around 6 months of taking pre-orders.

- Matching the demand expected, not under or over-supplying

With information about the high demand, Tesla has put together plans to ramp up production capacity.

- Locking advantage over competitors

Being the pioneer in the electric vehicle category, Tesla has managed to dominate the large luxury car market, which includes non-electric vehicles. Now who says they’re not on track to do the same in the small luxury market?

Moreover, those who have prepaid are more likely to go through with the purchase and less likely to buy something that catches their eye in the meantime.

Tesla 3 pre-order queue in Australia. Source: MarketWatch

Tesla 3 pre-order queue in Australia. Source: MarketWatch

The start-up vs. incumbent debate

There is a fear, especially among large corporations, that pre-commerce would reveal their strategic plan for everyone to see. While understandable, it doesn’t really help in a world of increasing connectedness and speedy spread of information.

A potential scenario is when information about new product development is leaked, which gives fast followers time to get their product to market right behind yours.

Pre-commerce actually works out better for established brands in this case. If your idea/prototype is already out in the marketplace, supporters will defend your company against copycats. Why?

- They’re paying for the experience rather than the physical goods. This goes back to the experiential buying trend.

- You already have a brand name and an engaged fan club (look at Tesla).

Final thoughts

Social media, direct-to-consumer platforms, business model innovations etc. have helped start-ups disrupt incumbents everywhere. Whether pre-commerce would do the same remains to be seen but if we’re to learn one thing in hindsight, embrace change before it overwhelms you.

In fact, some forward-looking incumbents have already accepted the fact that “it’s better to own a bit of a disrupting startup than be the prey of a new business model from an unknown competitor.” This is captured during Enabled’s recent trip to Lisbon to attend the Web Summit.

Remember: “What separates your brand and company from a world of innovative independent designers is only a semi-permeable membrane.”